Two or three years back, if I said to you that you could make money in thousands/ millions with a jpeg file, you wouldn’t have believed it. In fact, nobody would. But now jpeg’s minted on the blockchain (NFTs) has attracted celebrities to top companies.

NFTs are indirectly promoting block chain, cryptocurrencies, and decentralization among individuals. And not only that, it also gives the opportunity to make passive income for everyone irrespective of whether you are a creator or an ordinary person.

When you understand NFTs, you can make a lot of money. In this article, we have simplified the mechanisms of making money with NFTs. Ensure to read the full article for a better understanding. We damn sure that you will come to know a lot, if you read this till the end.

How Much Digital Art Creators Made Money from NFTs So Far?

| Artist | Total Value of Artworks |

| Beeple | $37,871,180.19 (8,046.382 ETH) |

| Pak | $62,499,842.31 (13,281.110 ETH) |

| Mad Dog Jones | $18,493,839.93 (3,985.149 ETH) |

| FEWoCIOUS | $27,495,769.23 (5,854.087 ETH) |

| 3LAU | $9,985,206.48 (2,125.937 ETH) |

For more interesting insights about trending NFT artists, check out our article Top 15 Famous NFT Artists to Follow.

How Creators Can Make Passive Income From NFTs?

Creators of any kind can make money from NFTs. For example, if you are a singer, you can mint your songs (btw, you can check what is minting in the next heading below) and announce that whoever owns your songs can earn up to 20% revenue from ad’s income. This encourages the audience to invest in your project.

First of all, by minting your song you completely own your project. There are no middlemen such as Google, Facebook, TikTok, etc to take your partial ad revenue (This is known as decentralization).

Secondly, as a creator you will earn money from two ways:

- From advertisements

- From your audience who owns your NFT

The key here is you have to increase your NFT’s utility. I.e. you can announce Whoever owns your NFT,

- will get 20% of your ad income

- will get preference in your concerts

- will enjoy pre-release of your albums, etc

Recently, 3LAU, an American DJ, released a song called “Worst Case” and created 333 tokens; these tokens combined represent 50% of ownership. Meaning 50% of the song’s revenue goes to 333 fans!

| Did You Know?

The “Worst Case” is the world’s first fan-owned (NFT) song. |

In the creator’s case, the whole process is like selecting and investing in potential stocks. If people see potential in you, they will invest for sure.

How an Ordinary Person Can Make Passive Income From NFTs?

There are two ways to make money from NFT:

- Minting: Creation of new NFTs

- Flipping: Buying and Selling already-created NFTs

Minting

Minting is an act of converting a digital file into a crypto asset or digital asset on the Ethereum block chain. A minter has to pay the gas fee.

If you are not interested in creating your own art like a creator, you can choose this path. It has its own advantage of owning an NFT with the lowest price; if it becomes famous, you will win a lottery mate!

Minting will be super profitable, at the same time it has high risk. You don’t know what is going to be the next CryptoPunk or Bored Ape Yacht Club project.

Hence, before minting an NFT, do proper market research. Otherwise, you will not succeed and lose your money invested. And you have to believe your instinct and predict the project.

But, how will you find the best projects to mint? Don’t panic. @ImSamThompson has got your back. Below are his insights:

- Go to rarity.tools to check new projects

- Analyze three metrics: Twitter followers, Discord community size, and number of items available

- Then, apply the Supply vs Demand rule. I.e. choose projects that are more followers than items available

- After eliminating weak projects through the above mentioned analytics, consider and apply 2 more perspectives to increase your probability of winning.

- Perspective 1: Study the founder’s mindset and planning

- Perspective 2: Is the art more than just a hype? I.e. Is it a part of any game, virtual world, has any other value, etc?

That’s it. You can now mint the project that you have filtered and wait for it to get popularity.

Flipping

Flipping NFTs means buying and selling in the secondary markets such as OpenSea, Rarible, etc.

If you are not interested in creating your own art and don’t want to take risks by minting, you can trade NFTs. It is less riskier compared to minting.

How to pick an NFT to trade/ invest?

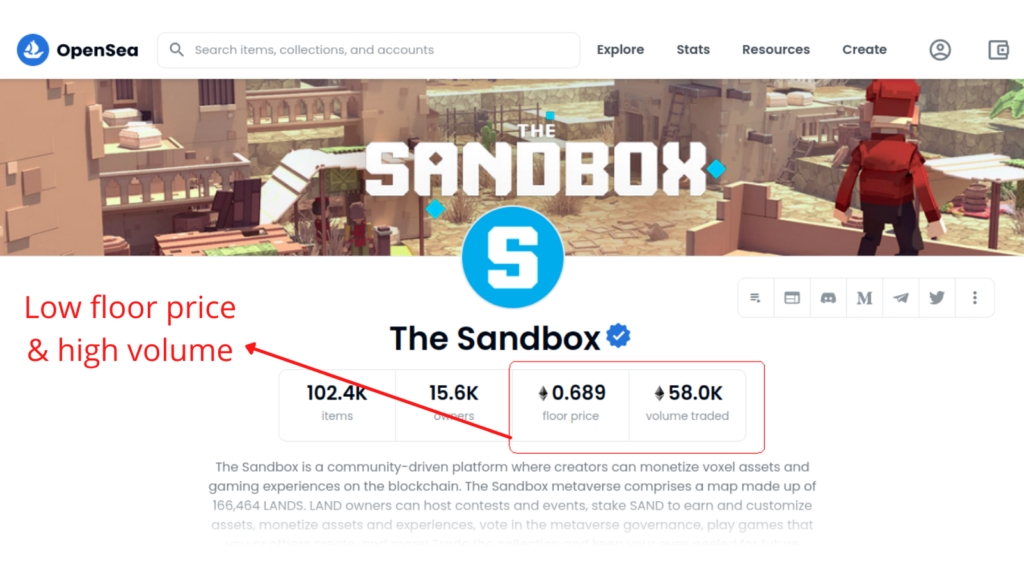

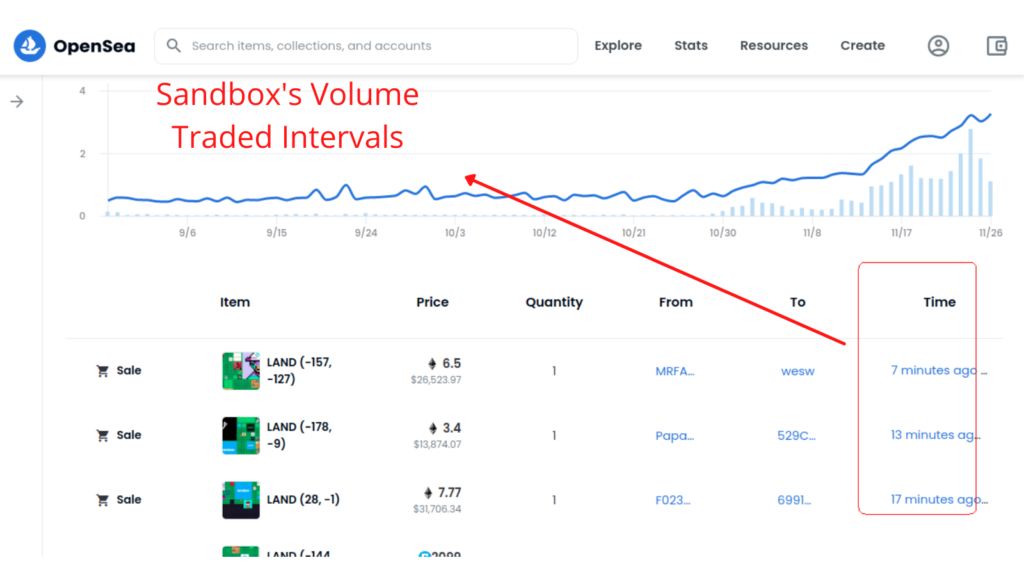

- Head to OpenSea and look for 3 metrics:

- Number of Items

- Floor Price—Lowest price for a collection item

- Volume Traded

According to Samuel Thompson, Floor price of -1 to 0.1 is the zone for Maximum Upside and Minimal Risk.

- Apply the Supply vs Demand rule. I.e. Choose the project with high volume and low floor price

- Look out for ‘Available Items’. Because it’s harder to move the floor price if items are over 10k.

- Go for limited supply projects, that’s where the floor price moves faster over time automatically; higher the floor price higher possibilities of making money

NOTE:

|

- To sum up, find balance between floor price, volume, and number of items

Now, you can buy the NFT that you have filtered through the above-mentioned analysis and wait for it to become more popular and sell it when you think you have earned enough money.

Hope you have found unique insights and strategies to mint and flip NFTs. Implement these strategies to earn passive income from NFTs. If you have any doubts, feel free to comment below.

Don’t forget to share. Sharing is caring!