NFTs are ubiquitous. Hence, before landing here, you could be familiar with words such as Beeple, Pak, Bored Ape, and Cryptopunks.

If not, check out Top 15 Famous NFT Artists to Follow and Best NFT projects (link will be uploaded soon).

According to Cointelegraph Research, the sale of NFTs might surge to $17.7 billion by the end of the year 2021. That’s a whopping number.

The NFT market is really big and you must not miss this. By participating in this NFT trend, you could earn a lot of money if you do the proper research. Even in the worst case, you will have a wonderful story to tell your grandchildren.

Remember, you don’t need to be an artist, singer, or celebrity to participate in this NFT trend. You could be an ordinary person and make a decent amount of money or privileges.

What is NFT?

Non-fungible Tokens (NFTs) are nothing but a jpeg file or an audio/ video file or a domain name or other type of digital file that is deployed (minted) on the blockchain.

NFTs can even be a virtual land too. In the month of November 2021, metaverse land sold for the record $2.4 million in Decentraland that drew the attention of the NFT community.

The main thing in NFT is that every single NFT is unique and it cannot be interchanged (non-fungible).

Any user can download/ save the NFT. However, they can’t claim ownership. Ownership of a particular NFT always belongs to the creator or the current holder of that NFT.

Best NFT Projects

You are mostly aware that NFT projects such as Bored Ape Yacht Club and CryptoPunks were taking over Twitter a few months back. Even now, they are in high demand due to scarcity.

Recently, Adidas has entered the NFT rally by buying a Bored Ape NFT. Bored Ape NFT (ERC-721 token) holders get some privileges such as accessing THE BATHROOM, a graffiti digital board. Each Bored Ape NFT holder has its full commercial usage rights.

Similarly, CryptoPunks holders can enjoy some benefits such as using them as VIP passes, loaning them out, and more.

Most of these NFTs are trading double and triple the mint price. Some of these NFTs given as free are now traded in the millions. The best part is every time someone resells any of these NFTs, the minter will receive a commission.

It is obvious that people who have bought one of the Bored Ape Yacht Club and CryptoPunks NFTs in the earlier stage would have bagged millions for sure.

Now, the latest NFT craze among people is Axie Infinity, The Sandbox, and Decentraland.

How to Find NFT Projects like Bored Ape Yacht Club and CryptoPunks?

The huge potential that NFTs have is clearly visible. If you find an NFT project and mint it before it takes off, you could also bag in millions.

But how to find projects like Bored Ape Yacht Club and CryptoPunks? How to do the NFT market analysis?

These are all the questions popping up in the mind of an ordinary person who yearns to make money in NFTs.

Don’t worry, @ImSamThompson has a strategy for us.

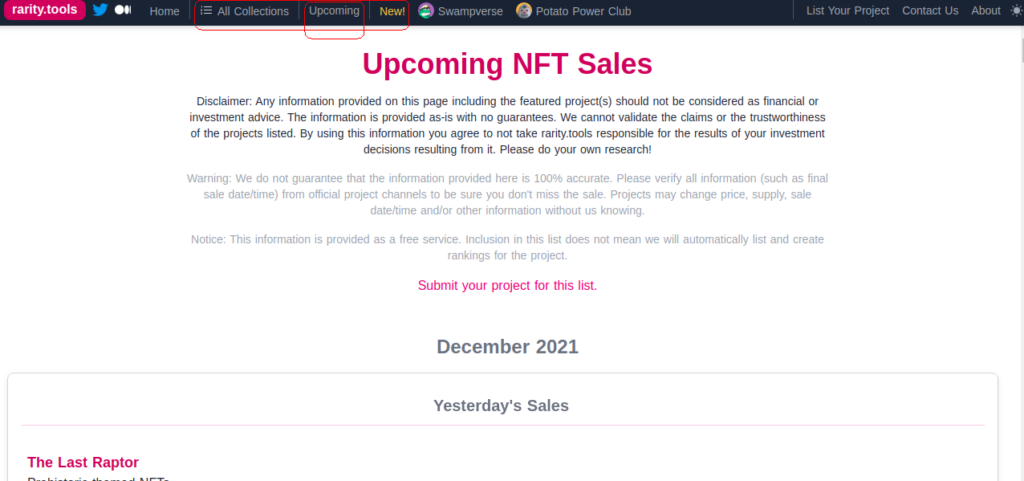

Step 1: Go to rarity.tools to check the new NFT projects

Step 2: Analyze 3 metrics: Twitter followers, Discord community size, and Number of items available

Step 3: Apply Supply vs Demand rule

Step 4: Apply 2 more perspectives

1. Go to the rarity.tools to check the new NFT projects

rarity.tools have a database of new, top, and upcoming NFT projects. It is one of the best and intuitive websites available in the market that ranks NFT projects based on the Rarity Score.

Each NFT community values its NFTs with different attributes. In the sea of NFTs, finding a potential NFT project manually is nearly impossible. This is where rarity.tools comes into play.

Once you are on the website, you could see nearly a month’s upcoming NFT project that is on sale.

Note: Though rarity is an essential and important factor in determining the value of individual NFT, it is not the only factor one should consider. That’s why we have further steps to find the potential NFT project.

2. Analyze 3 metrics: Twitter followers, Discord community size, and Number of items available

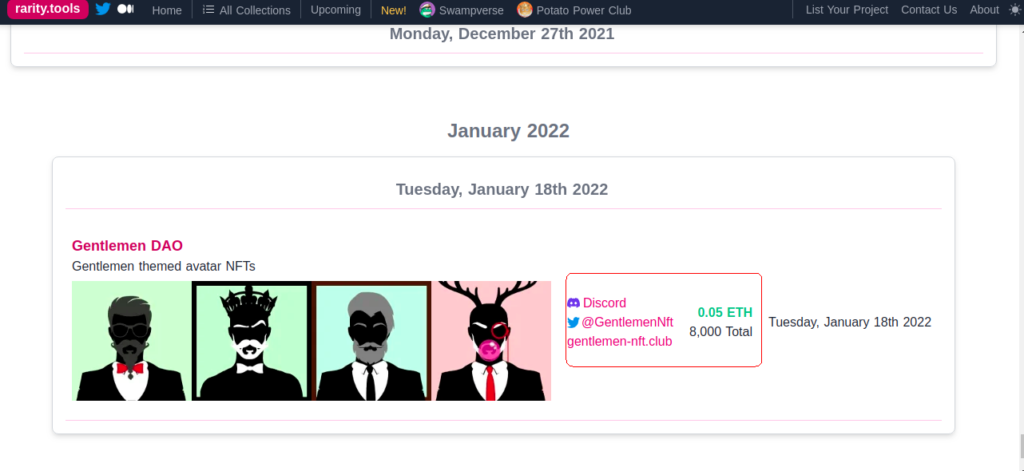

After selecting a few new projects, you could see Twitter followers, Discord community size, and the Number of items available besides those projects.

Note down all these numbers.

3. Apply Supply vs Demand rule

After collecting the above-mentioned 3 metrics, you can apply the simple Supply vs Demand rule.

I.e. weigh the Number of Total Followers and the Items Available

If a specific NFT project has more followers than the available items, mark it for the next stage of analysis.

Eliminate, if the NFT project has fewer followers than the available items.

4. Apply 2 more perspectives

To increase the probability of winning, you need to apply 2 more perspectives.

Perspective 1: Study the NFT project founder’s mindset and the project’s roadmap.

Find the founder/ creator of the particular NFT project on Twitter or their official website (if any). See how they are connected with the project and whether they have any revolutionary vision.

Perspective 2: Is the NFT project you chose more than just a fad? I.e. Is it a part of any virtual world, any game, has any other value, etc?

For example, if you want to play Axie Infinity—an NFT-based play-to-earn game—you need to buy at least 3 Axies from the Axie Marketplace.

In Decentraland—the first-ever virtual world where users can buy land—users can add any of their NFTs into their virtual land.

So, these NFTs have some real value.

5. Go for minting

You have done enough research mate! Why are you waiting? go for a mint.

Disclaimer: Investing in NFTs has its own risk; sometimes things can go out of control. Hence, invest only a few percent of money until you get some knowledge.

Now that you have the understanding to find and mint an NFT project before it takes off. We can move on to the minting part.

What is Minting?

Minting is an act of converting an ordinary digital file into a crypto/ digital asset on the Ethereum, Solana, Cardano, or Polkadot blockchain.

Among these blockchains, Ethereum and Solana are the popular blockchains (at the time of writing this post) when it comes to NFT.

A minter has to pay the gas fee. A gas fee is a cost for accessing (buying, selling, or transferring an asset in the blockchain) the blockchain. The gas fee is based on the demand of the particular blockchain and the NFT platform.

In Ethereum, the average gas fee for minting NFT is between $50-$500 whereas, in Solana, it only costs around $0.015. Want to mint NFTs for free?

How to Mint an NFT?

Since you need to pay the gas fee, you need cryptocurrencies (mostly Ethereum or Solana). To buy any cryptocurrency, read our article How to Buy Your First Cryptocurrency.

The above-mentioned article includes step-by-step instructions to create an account in a legit cryptocurrency exchange platform and buy any cryptocurrency.

Roadmap to mint:

Make sure to complete all the below-mentioned essential tasks before minting an NFT.

- Create an account in cryptocurrency exchange platform

- Buy cryptocurrency

- Create a crypto wallet (MetaMask in the case of Ethereum-based NFTs and Phantom or Solflare in the case of Solana-based NFTs)

- Send Ethereum (from Coinbase/ from Binance) or Solana (from Coinbase/ from Binance) into the wallet

It’s minting time.

Sign up into the NFT marketplace to mint NFTs. (OpenSea, NiftyGateway, and more in the case of Ethereum-based NFTs and DigitalEyes Market, Solsea, and more in the case of Solana-based NFTs)

To mint NFTs in OpenSea, read our article How to Mint NFTs in OpenSea using MetaMask.

To mint NFTs in DigitalEyes Market or Solsea, read our article (link will be uploaded soon)

This is how you can find and mint new NFT projects like Bored Ape Yacht Club and CryptoPunks before it takes off.

FAQs

Can I mint an NFT for free?

Yes, you can. OpenSea now has cross-blockchain support to eliminate the gas fee; users can mint NFT without gas fee on the Polygon blockchain.

The NFT marketplace Rarible introduced a new feature called “lazy minting” which allows users to mint NFTs at no cost.

What are the perks of minting NFTs?

- Minting an NFT has its own advantage of owning an NFT with the lowest price; if it becomes popular, you will win a lottery.

- Minting could be super profitable. At the same time, it has high risk if you don’t know what is going to be the next CryptoPunk or Bored Ape Yacht Club project.